Summary

In 2024, the UK health insurance market is experiencing rapid growth, driven by long NHS waiting times and a demand for quicker, more personalised healthcare, leading to a 41% increase in private health insurance sales.

To capitalise on these trends, healthcare organizations need to leverage market intelligence and innovation, ensuring they understand competitive dynamics and consumer preferences.

Introduction

In 2024, the National Health Service (NHS) remains a cornerstone of the UK healthcare system. However, long waiting times and growing demand for faster access to medical treatment are fuelling a surge in popularity for private health insurance.

A recent report into the UK health insurance market by Britain’s biggest general insurer found sales of health insurance had risen 41% compared with the previous year.

This shift in consumer behaviour presents significant opportunities for healthcare organisations to innovate and expand their offerings — catering to a market that’s increasingly seeking more flexible, efficient, and personalised healthcare solutions.

To effectively navigate this evolving landscape and capitalise on emerging opportunities, it’s crucial to gain a comprehensive understanding of the competitive landscape and market dynamics.

This includes gaining relevant insights into your competitors’ market positioning, offerings, pricing structures, and other key factors.

By leveraging market intelligence and competitive insights, you have the ability to make informed strategic decisions that align with changing consumer preferences and current market trends.

The UK Health Insurance Market: An Overview

The current landscape of the UK health insurance market is one of rapid evolution and growth. The market size is anticipated to achieve a value of £6.5 billion, growing at a compound annual growth rate (CAGR) of 4.56% from 2024 to 2029.

With an increasing number of people seeking alternatives to the National Health Service (NHS), the market has responded with a diverse range of offerings that cater to a variety of needs and preferences.

Key players such as AXA, BUPA, WPA, Simply Health, and Freedom Health Insurance are at the forefront of this burgeoning market — offering a plethora of health insurance plans designed to meet evolving expectations.

However, the market’s expansion is not solely driven by consumer demand for quicker and more reliable access to medical services.

It’s also influenced by broader economic factors, technological advancements, and societal shifts towards preventive healthcare measures.

These elements collectively contribute to a more dynamic and competitive environment, where understanding the nuances of current market dynamics becomes increasingly important.

Addressing Long NHS Waiting Times

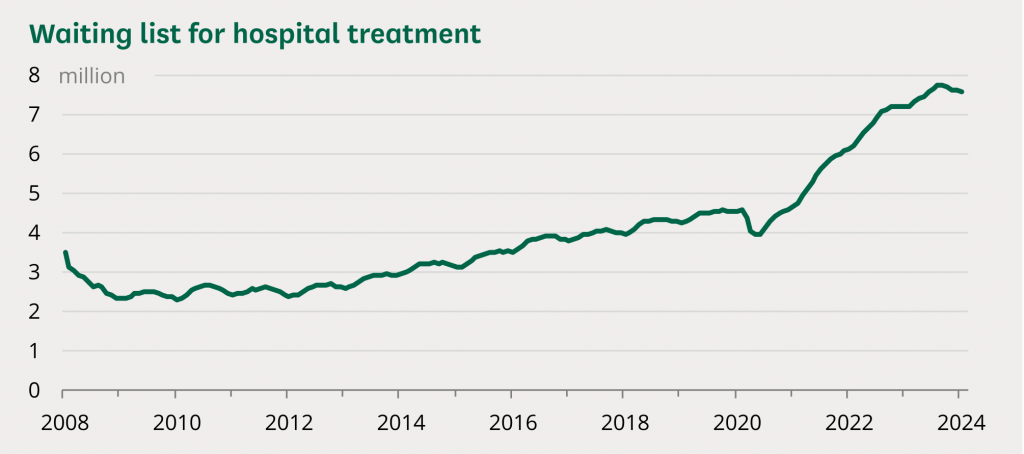

The National Health Service (NHS) is a vital source of healthcare for millions of people in the UK. But long waiting times are a growing concern and have had a significant impact on consumer behaviour.

Long NHS waiting times was found to be a key factor that is driving the recent surge in private health insurance as an alternative. People are increasingly willing to pay premiums for peace of mind and faster access to healthcare that private insurance offers.

This shift in consumer behaviour presents an opportunity for health insurers and private healthcare providers to cater to this growing market segment.

Importance Of Market Intelligence

Market intelligence plays a pivotal role in understanding the UK health insurance market, especially in areas of pricing dynamics, coverage options, and consumer preferences. It equips you with the knowledge needed to make data-driven decisions and gain a competitive edge in the market.

A) Pricing dynamics

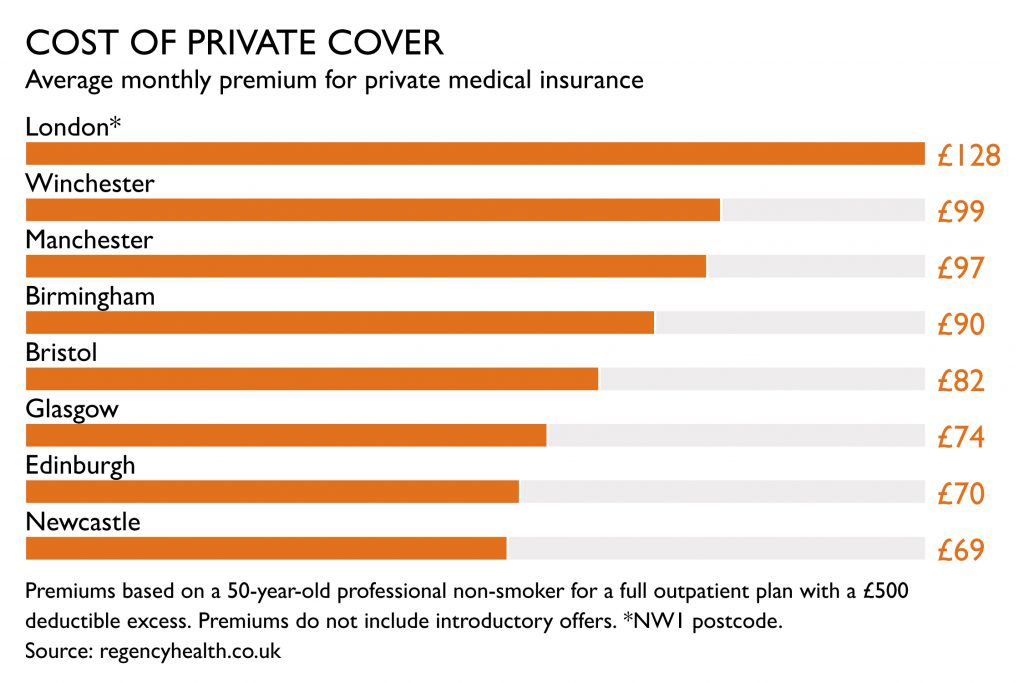

Market intelligence can provide in-depth insights into competitor pricing strategies by enabling you to analyse competitor plans, identify pricing gaps, and develop competitive offerings. It also allows you to optimise pricing structures to ensure your offerings remain profitable in a price-sensitive market.

B) Coverage options

Market intelligence can provide insights into popular coverage options, emerging trends in coverage, and gaps in the market that present opportunities for innovation.

Understanding the full spectrum of coverage options offered by competitors is key to developing a unique value proposition and achieving differentiation in the market.

C) Consumer preference

Market intelligence can help shed light on the most sought-after features and benefits, allowing you to tailor your products to meet the exacting demands of today’s discerning consumer.

By carefully analysing market trends, you can anticipate future demands and develop insurance plans that resonate with evolving consumer preferences.

Tracking Market Trends & Competitor Strategies

Market trends such as shifts in consumer preferences, technological advancements, or regulatory changes can significantly impact the health insurance market.

Tracking market trends allows you to anticipate any changes, adapt your strategies accordingly, and stay ahead of the curve. On the other hand, understanding competitors’ strategies provides valuable insights into what works and what doesn’t.

For example, if a competitor introduces a new and innovative health insurance product targeting a specific demographic, it provides valuable intelligence for other players to assess the viability of similar offerings.

1) Understanding competitor product offerings

Understanding your competitors’ product offerings not only gives you insights into what’s currently available in the market, it also opens up opportunities for innovation and differentiation.

This could involve creating new health insurance products, adding unique features to your existing offerings, or finding new ways to deliver value to your customers.

By filling gaps in the market with innovative solutions, you can meet customer needs more effectively, stand out from your competitors, and drive growth.

2) Importance of competitor pricing analysis

Competitor pricing analysis is vital for maintaining competitiveness without compromising profitability. By monitoring competitors’ pricing strategies, you can adjust your own pricing structures to remain attractive to consumers — while ensuring sustainable margins.

Additionally, understanding how competitors price their products can reveal insights into the perceived value of different insurance features and benefits. This information is crucial for optimising pricing strategies to maximise customer acquisition and retention.

3) Tracking competitor distribution channels

Distribution channels are the pathways your competitor’s use to deliver their products or services to customers.

In the context of the health insurance market, these could include direct sales through company websites, partnerships with brokers, or collaborations with other healthcare providers.

By analysing your competitors’ distribution channels, you gain insights into how they reach their customers.

Understanding these strategies can help you identify gaps in your own distribution channels and reveal new avenues to reach your ideal customers.

Regulatory Landscape & Compliance Considerations

.

Navigating the regulatory landscape is a critical aspect of operating in the UK health insurance market. The sector is governed by a set of strict regulations designed to protect consumers, ensure fair competition, and maintain the integrity of the market.

The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) are the primary regulatory bodies overseeing the UK health insurance market.

They set out rules and guidelines that insurers must adhere to, covering areas such as conduct of business, prudential standards, and policyholder protection. Recent developments in UK healthcare regulations have further emphasised the importance of transparency and consumer protection.

For example, insurers must provide clear and comprehensive information about policy renewals to ensure consumers can make informed decisions.

Compliance considerations for healthcare organisations

– Maintaining adequate financial resources.

– Managing risks effectively.

– Treating customers fairly.

– Reporting regularly to the regulatory authorities.

Non-compliance can result in penalties, such as fines and restrictions on business operations.

By staying up-to-date with regulatory developments and ensuring compliance, you can proactively mitigate risks, build trust with consumers, and contribute to a healthy market environment.

Future Outlook & Recommendations

Looking ahead, the UK health insurance market is poised for continued growth. The ongoing challenges with the NHS, coupled with an increasing awareness around the benefits of private health insurance, are likely to drive further adoption.

Technological advancements such as digital health platforms and telemedicine are also expected to shape the future of the market — offering new ways for insurers to engage with consumers and deliver services.

For healthcare organisations, this evolving landscape presents a wealth of opportunities. To effectively capitalise on these opportunities it’s essential to stay agile and responsive to changing market dynamics.

Practical recommendations

1) Continuous monitoring: Keep a close eye on market trends, competitor actions, and regulatory changes. This will allow you to anticipate shifts in the market and adjust your strategies accordingly.

2) Leverage technology & expertise: Utilise specialised software and industry expertise to garner market intelligence and competitive insights.

3) Innovation & differentiation: Strive to innovate in your product offerings, customer service, and overall business practices. Differentiate your organisation by delivering superior value in a way that’s unique to your organisation.

4) Compliance & risk management: Stay vigilant and aware of regulatory developments to ensure compliance. Implement robust risk management practices to safeguard your organisation and build trust with consumers.

5) Strategic partnerships: Consider partnering with other healthcare providers or tech companies to expand your service offerings and reach a wider audience.

Conclusion

The state of the UK health insurance market in 2024 is clear: there’s a growing inclination towards private health insurance as an alternative to the National Health Service (NHS).

This shift in consumer behaviour presents significant opportunities for healthcare organisations and leveraging market intelligence has never been more crucial.

Market intelligence enables you to make data-driven decisions and gain a competitive edge in a dynamic market where consumer preferences are shifting faster than ever before.